What is Qonto?

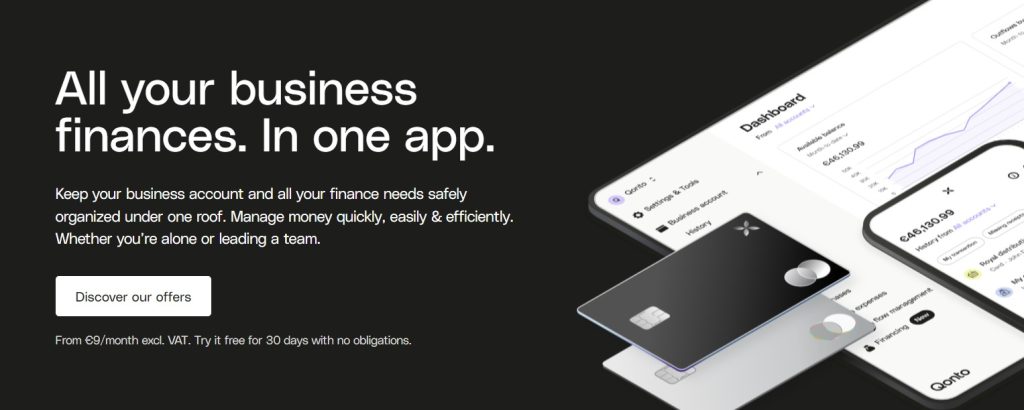

Qonto is an online banking platform designed specifically for businesses. It provides business owners with a range of features and tools to manage their finances effectively. With Qonto, you can perform various banking operations, including making and receiving payments, tracking expenses, generating reports, and collaborating with team members. It offers a user-friendly interface and integrates with other business tools to streamline financial management. Qonto prioritizes security and reliability, ensuring that your business funds are protected and transactions are conducted securely. Overall, Qonto aims to simplify business banking and provide entrepreneurs with a modern and efficient banking solution.

How Does Qonto Work?

Qonto works as an online banking platform specifically designed for businesses. It operates through a web application and a mobile app, providing users with convenient access to their accounts and financial tools. Here’s how Qonto works:

- Account Creation: To get started with Qonto, you need to create an account. You can sign up on their website or through the mobile app. During the registration process, you will be required to provide relevant business information and complete the necessary verification steps.

- Verification Process: Qonto implements a verification process to ensure the security and compliance of its users. You will need to submit identification documents and provide business-related information to verify your account. This process helps maintain a secure banking environment for all users.

- Account Dashboard: Once your account is verified and created, you will have access to the Qonto dashboard. The dashboard serves as the central hub for managing your finances. It provides an overview of your account balance, recent transactions, and other important details.

- Account Management: Qonto offers various tools and features to streamline account management. You can categorize transactions, create custom tags, and add notes to keep track of your expenses. Additionally, you can generate detailed reports and export them for accounting purposes.

- Payments and Transfers: Qonto allows you to make payments and transfers easily. You can set up payments to suppliers, clients, or employees using SEPA transfers (Single Euro Payments Area). Qonto also offers virtual cards, which can be used for online transactions and subscriptions.

- Expense Management: Qonto simplifies expense management by providing tools to capture and categorize receipts. You can easily upload receipts through the mobile app or forward them via email. Qonto automatically extracts relevant information from receipts, making it easier to track expenses.

- Collaborative Features: If you have a team, Qonto offers collaborative features that enable you to manage finances together. You can invite team members, assign roles and permissions, and monitor their transactions. This fosters transparency and simplifies financial operations within your organization.

- Integrations: Qonto integrates seamlessly with popular business tools and accounting software. This allows for automatic data transfer and synchronization, reducing manual work and enhancing efficiency. Integrations with tools like Xero, Slack, and Expensify provide a seamless workflow for managing your finances.

- Customer Support: Qonto provides customer support to assist users with any inquiries or issues they may encounter. You can reach out to their support team via email, live chat, or phone for prompt assistance.

Overall, Qonto operates as a comprehensive online banking solution tailored to the needs of businesses. It offers a secure and user-friendly platform, simplifying banking operations and providing business owners with the tools they need to manage their finances effectively.

Is Qonto Safe?

Yes, Qonto is committed to ensuring the safety and security of its users’ accounts and financial data. Here are some measures Qonto takes to provide a safe banking experience:

- Encryption: Qonto employs strong encryption protocols to safeguard sensitive data. This includes encryption of data in transit and at rest, ensuring that information remains secure during transmission and storage.

- Regulatory Compliance: Qonto is a licensed payment institution under the supervision of regulatory authorities. This means they adhere to strict compliance standards and regulations to ensure the safety of customer funds and transactions.

- Two-Factor Authentication (2FA): Qonto offers two-factor authentication as an additional layer of security. Users can enable 2FA, which requires a verification code in addition to their login credentials, providing an extra level of protection against unauthorized access.

- Fraud Detection: Qonto implements advanced fraud detection mechanisms to identify and prevent fraudulent activities. They use algorithms and systems that continuously monitor transactions for suspicious patterns or behavior, enabling them to take swift action when necessary.

- Secure Infrastructure: Qonto maintains a secure infrastructure for their platform, including robust firewalls and intrusion detection systems. They regularly update and patch their systems to protect against vulnerabilities and stay ahead of emerging security threats.

- Compliance with Data Protection Regulations: Qonto complies with data protection regulations, such as the General Data Protection Regulation (GDPR). They prioritize the privacy and confidentiality of user data, ensuring it is handled securely and responsibly.

- Ongoing Security Audits: Qonto conducts regular security audits and assessments to identify and address any vulnerabilities or weaknesses in their systems. This proactive approach helps them maintain a secure banking environment for their users.

It’s important to note that while Qonto implements robust security measures, users also play a role in maintaining the safety of their accounts. It is recommended to use strong and unique passwords, enable two-factor authentication, and exercise caution when sharing sensitive information.

By prioritizing security and employing multiple layers of protection, Qonto aims to provide a safe and reliable banking platform for businesses.

Benefits of a Verified Qonto Account

A verified Qonto account provides several advantages for business owners. Let’s delve into the key benefits below:

Enhanced Security and Reliability

Keeping your business finances secure is a top priority. With a verified Qonto account, you can rest assured that your funds are protected by robust security measures. Qonto implements state-of-the-art encryption protocols, ensuring that your financial data is safe from unauthorized access. Additionally, Qonto is a licensed payment institution under the supervision of regulatory authorities, adding an extra layer of trust and reliability to their services.

Simplified Account Management

Managing multiple accounts and handling various transactions can be time-consuming. However, with a verified Qonto account, you can streamline your account management process. Qonto offers a user-friendly interface that allows you to organize your finances efficiently. You can categorize transactions, generate detailed reports, and gain valuable insights into your business expenses, making it easier to track your financial health.

Seamless Payment Solutions

Qonto enables you to make and receive payments seamlessly. Whether it’s paying suppliers, receiving client payments, or conducting international transactions, Qonto offers a range of payment options tailored to your needs. With features like virtual cards, SEPA transfers, and international transfers, Qonto simplifies the payment process, saving you time and effort.

Efficient Expense Management

Tracking and managing expenses is essential for maintaining a healthy financial status. Qonto provides tools to streamline your expense management process. You can easily capture receipts, categorize expenses, and generate detailed expense reports within the Qonto platform. This eliminates the need for manual record-keeping, saving you valuable time and ensuring accurate financial documentation.

Collaborative Banking for Teams

If you operate a business with multiple team members, Qonto offers collaborative features that enhance your banking experience. You can provide controlled access to team members, assign specific roles and permissions, and streamline financial operations within your organization. Qonto allows you to invite team members, set spending limits, and monitor transactions, ensuring transparency and accountability.

Integrations with Business Tools

Qonto integrates seamlessly with popular business tools, further simplifying your financial management. You can connect Qonto with accounting software, expense management platforms, and other applications that you use to run your business. This integration automates data transfer, reduces manual work, and enhances the overall efficiency of your business operations.

Buy Verified Qonto Account: Streamline Your Business Banking

A verified Qonto account can revolutionize your business banking experience. By opting for a verified account, you gain access to advanced features and added security measures. Below, we’ll explore the process of buying a verified Qonto account and how it can benefit your business.

Finding a Trusted Provider

When looking to buy a verified Qonto account, it’s crucial to find a trusted provider. Conduct thorough research to ensure the provider has a reliable track record and positive customer reviews. Look for established providers who offer genuine, fully verified Qonto accounts to avoid any potential risks.

Understanding the Verification Process

To maintain a secure banking environment, Qonto employs a stringent verification process. When purchasing a verified Qonto account, you’ll need to provide the necessary identification documents and business information. The provider will guide you through the verification process, ensuring compliance with Qonto’s requirements.

Streamlined Account Setup

Once your verified Qonto account is acquired, the setup process is quick and straightforward. The provider will assist you in setting up your account, configuring features based on your business needs, and ensuring a smooth transition to your new banking solution.

Enjoying the Benefits

With your newly purchased verified Qonto account, you can leverage all the benefits discussed earlier in this article. From enhanced security and simplified account management to efficient expense tracking and collaborative banking for teams, Qonto empowers your business to thrive.

Frequently Asked Questions (FAQs)

Here are some common questions about buying a verified Qonto account:

- What are the advantages of buying a verified Qonto account?

- Buying a verified Qonto account provides you with enhanced security, simplified account management, seamless payment solutions, efficient expense management, collaborative banking features, and integrations with business tools.

- How can I find a trusted provider to buy a verified Qonto account?

- Conduct thorough research, read customer reviews, and choose an established provider with a reliable track record in offering genuine, fully verified Qonto accounts.

- What is the verification process for a Qonto account?

- The verification process for a Qonto account involves submitting identification documents and providing necessary business information to comply with Qonto’s requirements.

- Is the setup process for a verified Qonto account complicated?

- No, the setup process for a verified Qonto account is quick and straightforward. The provider will guide you through the setup, configure features based on your needs, and ensure a smooth transition.

- Can I enjoy all the benefits of a Qonto account after purchasing a verified account?

- Absolutely! Once you acquire a verified Qonto account, you can immediately leverage all the benefits, including enhanced security, simplified account management, and collaborative banking features.

- Are there any risks associated with purchasing a verified Qonto account?

- As long as you choose a trusted provider, the risks associated with purchasing a verified Qonto account are minimal. Ensure you conduct proper research and choose a provider with a good reputation.

Conclusion

In conclusion, a verified Qonto account offers numerous benefits for businesses looking to streamline their banking operations. From enhanced security and simplified account management to efficient expense tracking and collaborative banking features, Qonto provides a comprehensive solution tailored to the needs of modern entrepreneurs. If you’re in search of a reliable banking platform that can take your business to new heights, buying a verified Qonto account might be the ideal choice for you.

Reviews

There are no reviews yet.